Contents:

Capital structure deals with how a firm finances its overall operations and growth through different sources of funds, which may include debt such as bonds or loans. The other approach is to look at the credit rating of the firm found from credit rating agencies such as S&P, Moody’s, and Fitch. A yield spread over US treasuries can be determined based on that given rating. That yield spread can then be added to the risk-free rate to find the cost of debt of the company. This approach is particularly useful for private companies that don’t have a directly observable cost of debt in the market.

Because interest payments are deductible and can affect your tax situation, most people pay more attention to the after-tax cost of debt than the pre-tax one. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective»), an SEC-registered investment adviser.

- Balance sheet ratios include liquidity ratios (measuring the company’s ability to meet its short-term obligations) and solvency ratios (measuring the company’s ability to meet long-term and other obligations).

- It can either refer to the after-tax cost of debt or to the pre-tax cost of debt .

- INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

- Ideally, the expected yield to maturity would be calculated based on the current market price of the noninvestment grade bond, the probability of default, and the potential recovery rate following default.

- For example, a bank might lend $1 million in debt capital to a company at an annual interest rate of 6.0% with a ten-year term.

Apart from the principal amount, how to calculate stockholders equity usually incurs interest as ‘cost’ to get loaned funds. Once you at all those up, you’ll have the total liabilities or debt obligation for your company. This way, they can tell whether the company in question is handling its finances responsibly.

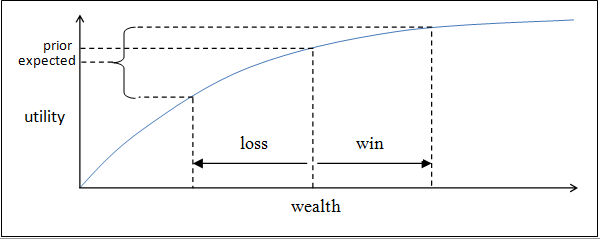

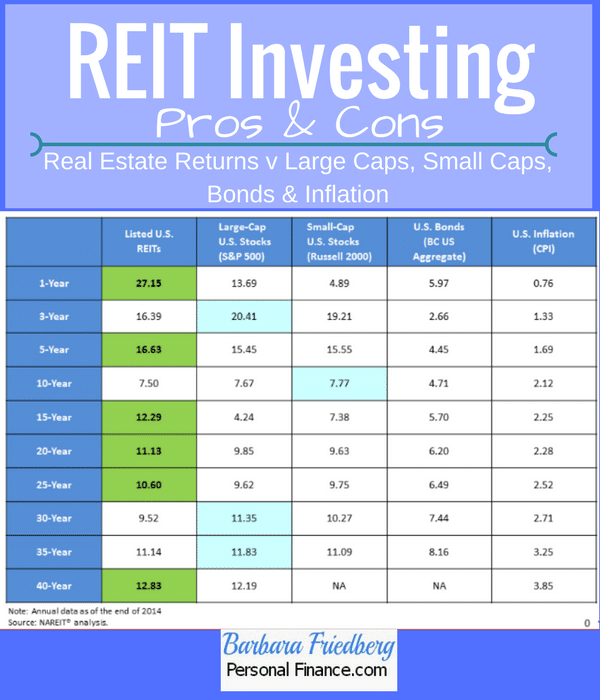

Ideally, the expected yield to maturity would be calculated based on the current market price of the noninvestment grade bond, the probability of default, and the potential recovery rate following default. Debt and equity capital both provide businesses with the money they need to maintain their day-to-day operations. Equity capital tends to be more expensive for companies and does not have a favorable tax treatment. Too much debt financing, however, can lead to creditworthiness issues and increase the risk of default or bankruptcy. As a result, firms look to optimize their weighted average cost of capital across debt and equity. The weighted average cost of capital is a calculation of a company’s cost of capital, or the minimum that a company must earn to satisfy all debts and support all assets.

How to Calculate Cost of Debt

The cost of equity doesn’t need to be paid back each month like the cost of debt. Instead, repayment is generated through returns on shares, like dividends and valuations. The effective tax rate listed on the income statement will tell you what taxes were charged.

Cost of Equity Definition, Formula, and Example – Investopedia

Cost of Equity Definition, Formula, and Example.

Posted: Sat, 25 Mar 2017 18:59:01 GMT [source]

To estimate the β coefficient of a specific stock, the regression of the returns of the stock against returns on a market index is used. If the stock does not have a β coefficient, and such is the case when a company is not listed, it is necessary to use the β of the comparables. This requires identifying the β of a comparable, then unlever the β with comparable data, and at the end re-lever the β with the company’s debt and equity structure.

You need to understand what total liabilities are and how they affect your balance sheet if you’re an accountant or business owner. Total liabilities can be thought of as the broad economic obligations of an organization. Deferred tax liabilities arise from temporary timing differences between a company’s income as reported for tax purposes and income as reported for financial statement purposes. Liabilities expected to be settled or paid within one year or one operating cycle of the business, whichever is greater, are classified as current liabilities. Liabilities not expected to be settled or paid within one year or one operating cycle of the business, whichever is greater, are classified as non-current liabilities. Some assets and liabilities are measured on the basis of fair value and some are measured at historical cost.

How To Calculate the Cost of Debt Capital

It gives the market’s expected to return at different levels of systematic or market risk. It is also called the ‘characteristic line’ where the x-axis represents the asset’s beta or risk, and the y-axis represents the expected return. When calculating the possible revenue you might expect from the loan, the duration becomes increasingly important. If your loan has a healthy potential, you know it’s worth taking the risk; if it doesn’t, you might as well consider other ways to achieve your business objectives. To illustrate this concept, let’s say that Company X paid $10 million in interest last year.

A higher long-term debt ratio requires the company to have positive and steady revenue to prevent raising alarm regarding solvency. To better make a good judgment concerning a business’s ability to pay debts, we need to look at the industry standard. For instance, corporations that deal with basic needs such as electricity or gas tend to have more stable cash inflows. In a nutshell, your total liabilities plus total equity must be the same number as total assets. If both sides of the equation are the same, then your book’s “balance” is correct. For example, a small pet store owes $500 in accounts payable for its utility bills, phone and internet bills, and more.

For example, over 50 years a $10 million cash flow growing at 10% becomes a $1 billion annual cash flow. In some cases, particularly industries in sustained secular decline, a zero or negative rate may be appropriate. If a firm can borrow at an interest rate of 11%, and if it has a marginal federal plus state tax rate of 40%, then it’s after tax-cost of debt is 6.6%.

Cost of Capital Formula

Most managers start with the https://1investing.in/ that an equity investor would demand on a risk-free investment. Some 46% of our survey participants use the 10-year rate, 12% go for the five-year rate, 11% prefer the 30-year bond, and 16% use the three-month rate. When this article was drafted, the 90-day Treasury note yielded 0.05%, the 10-year note yielded 2.25%, and the 30-year yield was more than 100 basis points higher than the 10-year rate. Say, for instance, an investment of $20 million in a new project promises to produce positive annual cash flows of $3.25 million for 10 years. If the company has underestimated its capital cost by 100 basis points (1%) and assumes a capital cost of 9%, the project shows a net present value of nearly $1 million—a flashing green light. But if the company assumes that its capital cost is 1% higher than it actually is, the same project shows a loss of nearly $1 million and is likely to be cast aside.

AT&T: Crushed By Too Much Debt (NYSE:T) – Seeking Alpha

AT&T: Crushed By Too Much Debt (NYSE:T).

Posted: Mon, 10 Oct 2022 07:00:00 GMT [source]

Default risk, the likelihood the firm will fail to repay interest and principal on a timely basis, can be measured by the firm’s credit rating. Default rates vary from an average of 0.52% for AAA-rated firms over a 15-year period to 54.38% for those rated CCC by Standard & Poor’s Corporation. To calculate the expected rate of return or cost of equity, the capital asset pricing model uses the risk-free rate, the risk premium of the wider market, and the beta value of the company’s shares.

Since the interest rate is a semi-annual figure, we must convert it to an annualized figure by multiplying it by two. If you only want to know how much you’re paying in interest, use the simple formula. Earnings before interest, depreciation, and amortization measures earnings and adds the interest expense, depreciation, and amortization to net income. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

However, based on market behavior in aggregate and the unpredictability in question, the debt holders might reasonably expect some level of return on investment. To keep the debt holder committed, companies must be able to deliver returns that meet or exceed this level, such as robust stock prices and dividends. Debt financing does not dilute the owner’s interest in the company. Interest paid until the loans are paid off, on the other hand, can take a long time, especially when interest rates are rising.

Keep in mind that most companies choose to use debt as a means of financing because it is markedly cheaper than equity. Federal Reserve, 43% of small businesses will seek external funding for their business at some point—most often some kind of debt. Knowing the after-tax cost of the debt you’re taking on is crucial when trying to stay profitable. Interest payments are tax deductible, which means that every extra dollar you pay in interest actually lowers your taxable income by a dollar. Another example of a non-debt liability is unearned revenue, which is earnings received by a business for service that hasn’t been delivered yet.

What’s the difference between debt financing and equity financing?

If your company is perceived as having a higher chance of defaulting on its debt, the lender will assign a higher interest rate to the loan, and thus the total cost of the debt will be higher. Equity is the amount of cash available to shareholders as a result of asset liquidation and paying off outstanding debts, and it’s crucial to a company’s long-term success. While reviewing balance sheets and other financial statements can help answer this question, a firm grasp of financial concepts—such as cost of capital—is critical to doing so. With two variables weighted average cost of capital and growth rate.

Weighted Average Cost of Capital (WACC) Explained with Formula … – Investopedia

Weighted Average Cost of Capital (WACC) Explained with Formula ….

Posted: Sat, 25 Mar 2017 23:42:52 GMT [source]

To better put it into perspective, most current liabilities are even categorized as non-interest bearing current liability . Meanwhile, long-term debt makes up the bigger chunk of non-current liabilities with its comparably higher interest. In general, assets are things that the company truly own as well as other things that belong to someone else .

- If you’re using Excel, plug in your assets and equity and make sure the equation works.

- Our company pays a tax rate of 30%, and it saves $1,500 in taxes by expensing the interest.

- Additionally, the cost of debt is used to calculate other important financial metrics, such as the weighted average cost of capital .

- The calculation includes the company’s debt and equity ratios, as well as all long-term debt.

- For example, if your total debt is $50,000 and the total interest you are paying on all your loans for the current year is $3,500, then the simple cost of debt will be 7%.

Rate Of Return ExpectedThe hurdle rate in capital budgeting is the minimum acceptable rate of return on any project or investment required by the manager or investor. It is also known as the company’s required rate of return or target rate. Book Value Of DebtThe book value of debt is the total amount the company owes, which is recorded in the company’s books. It is used in liquidity ratios compared to the company’s total assets to check if the organization has enough support to overcome its debt.

With an increase in income of the business, one can avail more debt as he can afford it. The cost of debt is compared with income generated by loan amount, so increasing business income can reduce the cost of debt. To know a company’s actual financial position, one can also calculate the after-tax debt cost. Now, let’s see a practical example to calculate the cost of debt formula. Now, we can see that the after-tax cost of debt is one minus tax rate into the cost of debt.